In LoanScouter, we are aware that it can be difficult, confusing and time-consuming to find your way around today’s online loan market.

Therefore, we’ve embarked on a mission to make the online loan market more transparent and accessible for consumers who are looking for the best possible loan conditions.

However, when promoting transparency in the loan market, we are also obliged to be transparent about how we operate as a business.

- Below, we will explain to you…

- What is LoanScouter, and how exactly do we help customers find the right loan

- How LoanScouter manages to generate profits when the service is 100% free of charge

- What are LoanScouter’s responsibilities – and what is not our responsibility

What does LoanScouter do?

LoanScouter is an online comparison engine, revolving around financial solutions for you and your individual needs. We strive to provide the best financial products to consumers on a global scale.

When entering LoanScouter, you will be presented with a list of eligible loan offers. All of the loans on the list are accompanied with information about minimum and maximum loan amount, maturity, estimated payout time, interest rates, and other related costs.

Additionally, we’ve spent a great amount of time reviewing the most popular banks and loan providers in today’s market, informing you about, among other things, the pros and cons for applying at one lender over another.

Consequently, LoanScouter’s free comparison service enables you to easily and quickly compare a diverse range of loan types.

How does LoanScouter generate profit?

LoanScouter’s comparison service is 100% free of charge and non-binding. This means that you are not being charged any additional fees when applying for a loan through LoanScouter.

In other words, it is not more expensive to take a loan using LoanScouter compared to applying directly through the lender’s website.

This most likely raises the question of how we make money. LoanScouter has an advertising relationship with some of the lenders that occur on the loan list. More precisely, LoanScouter generates profit through affiliate marketing.

Affiliate marketing explained

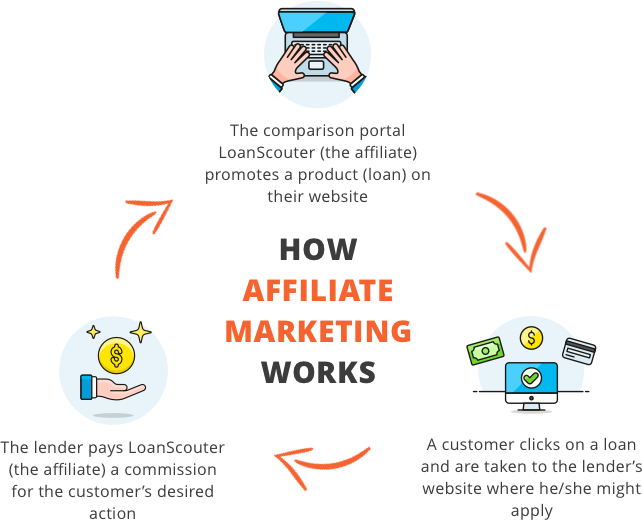

Affiliate marketing is when a publisher (in this case, LoanScouter is the publisher) earns a commission by promoting somebody else’s product or service (in this case, lenders with whom we collaborate). When a customer takes a desired action, e.g. applies for a loan with one of the lenders form LoanScouter’s list, the lender in question pays a commission to the publisher (LoanScouter).

This means that the lenders on the list pay us a referral fee for directing new customers to their website. Therefore, when you access an application link through our site, we may receive compensation when your application is completed and approved.

For a better understanding of how we at LoanScouter work with affiliate marketing, check out the illustration below.

Information about loans on our list

In LoanScouter, we continuously update our loan selection with new loans and the latest conditions in order to ensure an inclusive loan list and up-to-date information. However, we maintain the right for changes in data about loans that lenders have changed without informing us which may result in different information on our site and the lender’s site. In this case, you ought to rely on the information you find on the lender’s site and/or contact the lender directly in order to get the correct information.

Contracts and other agreements

LoanScouter is not involved in the arrangement between borrowers and lenders and least of all in the drafting of a contract. In this sense, LoanScouter is under no circumstances blameworthy for the content of the contract nor for any violation of the contract, no matter whether it is the lender or borrower who breaches the contract. For more information about LoanScouter’s stand on possible conflicts between lenders and borrowers, please read the section below.

Conflicts between lender and borrower

LoanScouter is not involved in the loan agreement between lender and borrower and can therefore not be held responsible for any conflict that might occur – loan-related or not. If a customer experiences any kind of problem with a lender, all questions and complaints regarding this should be directed at and, consequently, handled by the lender with whom the customer is having issues.

Responsible lending and borrowing

We strongly advocate responsible lending and borrowing. In fact, we see it as one of our strongest responsibilities to inform customers about it. However, it is the customers’ own responsibility to borrow money with responsibility. Responsible borrowing does not mean that you cannot get a loan if you have a low income; it means that you should at least have your personal finances under control.

Handling personal data

In LoanScouter, we take processing of your data very seriously, so you can be sure that we comply with personal data legislation. LoanScouter only collect relevant and necessary personal data and only for specific purposes. Customers’ personal data is only available to us and is under no circumstances revealed to third parties. You can read more about how we ensure fair and transparent processing of personal data in our privacy policy.